County changes banking strategy

By Jeremy Nash [email protected]

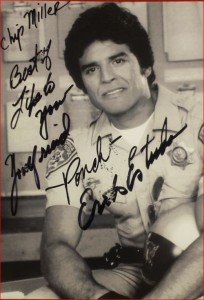

Following Loudon County Commission’s recent approval to establish a new check clearing system to pay vendors through First National Bank, Loudon County Trustee Chip Miller hopes to soon have all accounts transferred from BB&T to begin what he believes is a more efficient way for the county to do its banking.

Miller said daily operations, such as checking, deposits and clearing of accounts, will be handled by First National Bank. FSG Bank will handle the county’s idle funds and place them into an investment account, including accounts for the Loudon County Solid Waste Disposal Commission reserve fund and the county reserve fund.

The county’s involvement with FSG on a daily basis will be “limited,” he said. Funds will be bulked together at the end of each day. As a result, Miller said the setup will be “cleaner” than what the county has with BB&T, which has provided services to the county for 39 years.

“It’s going to reduce duplication. It’s going to reduce the risk of errors,” Miller said. “We do have errors that go in between the two accounting systems, and when that happens it bogs both systems down versus one person looking for why didn’t this balance. In a nutshell, it’s going to allow us to focus on the taxpayer, focus on idle — investing idle funds.”

The switch, which Miller hopes to have fully made by Monday, will go from a modified warrant system to a “true trustee” checking system that will allow the trustee’s office to operate in a more timely and efficient manner by moving money in a single transfer instead of individual accounting with every check.

“We’ll go to First National every day to make the deposit,” Miller said. “Tracy Blair’s office, which we work very closely with, will be sending us down the same fax that we get today, but instead of getting 40 (requests) of them we’ll get seven of them and they’ll say, ‘This is what we need.’ So we’re trying to spread that many in there, and they’ll write the checks like they do now.”

Blair, county budget director, said the county’s payroll checking accounts have been set up in this different method for “quite some time.” The details will still need to be ironed out, but Blair said she thought her department will be able to make fewer requests per day to the trustee’s office.

“The way things are right now, the trustee reconciles to the bank for all of the vendor checks, and then my department reconciles to the trustee’s office,” Blair said. “We are required to do that, each check. So, it’s not that we’re not reconciling at all for our vendor checks. It’s just that right now the trustee’s office reconciles with the bank for each check, and now my department will reconcile with the bank for each vendor check.

“We will still have to reconcile overall balances with the trustee’s office because the trustee will still be making cash transfers into the checking clearing accounts for whatever the total amount of checks are that day,” she added. “So, he’s still, he — the trustee — the trustee’s office still has a reconciliation with the bank at that level and then we still have a reconciliation, so it’s not that we don’t reconcile, we do, it’s just that the manner in which that reconciliation is done will change.”

Currently, two accounts have been transferred to FSG Bank. The county reserve fund on Nov. 19 totaled more than $8.7 million, and the Loudon County Solid Waste Disposal Commission reserve fund, as of the same date, was about $1.5 million. The main account at BB&T still has more than $17 million. Miller said the county will continue to do business with BB&T, albeit on a lower scale.

“We will also still maintain a relationship with BB&T in that Tellico Village has a BB&T branch,” Miller said. “… We receive payments and stuff from BB&T. If you’re a Tellico Village taxpayer, and you don’t want to come all the way down here, you can drop off your check as long as you have your bill at BB&T in Tellico Village and in Greenback, which we know that’s about as far as you can get from the county seat.”

The shift in banking to FSG Bank has boosted the county investment rate to 45 basis points, Miller said. An investment in earnings is expected to be $101,000-$105,000, and Miller said he believes that figure will be sustainable. Basis points are units of measure used to describe a percentage change in value or rate.

“That’s not a ceiling, that’s a floor,” Miller said. “That number is fixed for a year. I think that it’s very sustainable. I can’t imagine rates going any lower, and so I think that number in my opinion only has the potential to increase.”

Miller said “several other banks” were considered, but ultimately he thought the best situation would be to have one bank handle the checking, deposits and clearing, and another bank handle the Federal Deposit Insurance Corporation-insured investments.

“We’re part of the community,” David Allen, president of First National Bank, said. “This bank is here, and if we can’t jump in and help the county trustee when he needs help, then that’s — we’re part of the community, that’s what we’re here for.”

Miller said BB&T previously required the county maintain at least $18 million in the bank without drawing fees.

“I think it’s a great opportunity for us,” Matt Webster, commercial banking officer at FSG, said. “We’ve got the office there in Lenoir City, and one of the things that FSG wants to do is focus on community banking and small business relationships, and part of that we’re focused on going out and working with county governments, school districts, utility companies, anything of that nature.”